Cup And Handle Chart Pattern . Cup & handle pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. A cup and handle pattern is a bullish continuation pattern.this stock is making a cups and handles in its daily time frame.

Cup And Handle Patterns - Comprehensive Stock Trading Guide from scanz.com

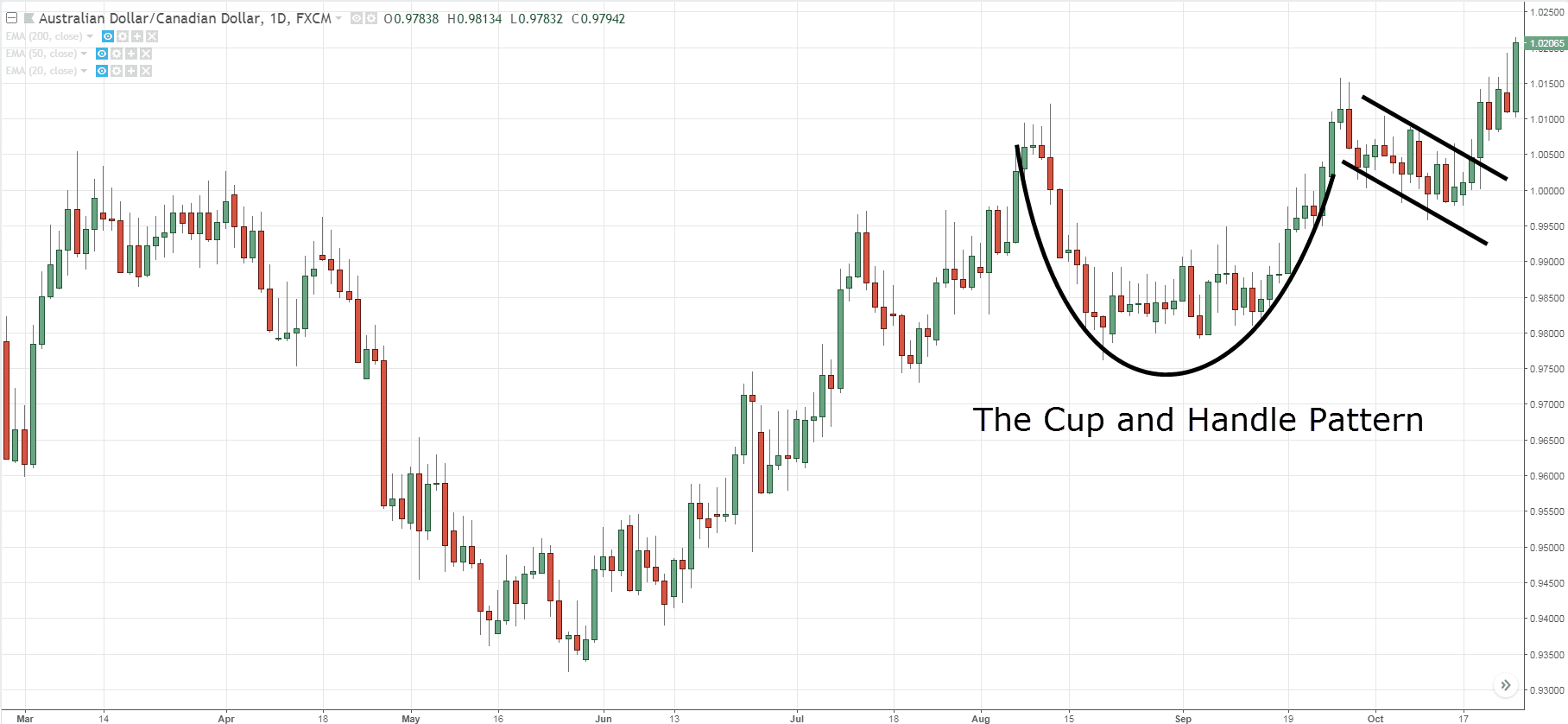

In between it takes a break, it forms a pattern that resembles a cup with a handle. This is a very reliable chart pattern and typically offers a very low risk compared to the rewards. Chart patterns occur when the price of an asset moves in a way that resembles a common shape, like a triangle, rectangle, head and shoulders, or—in this case—a cup and handle.

Cup And Handle Patterns - Comprehensive Stock Trading Guide

The pattern on the gold chart above has been happening since 2011. A classic cup w handle pattern formation can take an entry with an sl. If it get a break out, you can go with profit. The rise leading to the cup with handle begins at c and reaches the left cup lip at point a.since this is on the weekly scale, the price chart appears narrower than usual, but price rounds downward forming a cup with the right cup lip at b.the handle lasts a few weeks.

Source: www.tradingwithrayner.com

Trading cup and handle patterns; The cup with handle formation was popularized by william j. Hfcl is at ath and at llr. While tight consolidation phase in the opposite direction resembles like a handle. 17/1/22 sail cup and handle formation cup and handle formed on a weekly time frame cmp@107.65 the targets will be @125/142/150/174/194.

Source: www.ig.com

Hfcl is at ath and at llr. The cup part of the pattern is where the price gradually changes its direction from bearish to bullish.the handle part is when the price pullback slightly before roars higher and continues the previous trend. One of the most popular chart patterns is the cup and handle pattern. In between it takes a break,.

Source: www.investopedia.com

Cup & handle pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. The cup and handle chart pattern is a continuation chart pattern and it is generally formed in the bullish market. How to find momentum stocks; Pop probability is looking good. The cup part of.

Source: www.tradingview.com

After forming the cup, price pulls back to about ⅓ of the cups advance, forming the handle. The handle breakout is a way of confirming the pattern. Cup and handle chart pattern: The cup is in the shape of a “u” and the handle has a slight downward drift. 17/1/22 sail cup and handle formation cup and handle formed on.

Source: www.thebalance.com

The handle breakout is a way of confirming the pattern. The figure on the right shows an example of a cup with handle chart pattern. If it get a break out, you can go with profit. After forming the cup, price pulls back to about ⅓ of the cups advance, forming the handle. It is this formation that gets the.

Source: scanz.com

The pattern on the gold chart above has been happening since 2011. A cup and handle pattern is a chart pattern that takes the shape of a cup with a handle. It was developed by william o'neil and introduced in his 1988 book, how to make money in stocks. Discover what bullish investors look for in stocks and other assets..

Source: scholar.harvard.edu

The cup and handle chart patterns triggers a signal when it breaks out of the handle. Pop probability is looking good. Cup and handle chart pattern. How to find momentum stocks; After that break, the stock again starts heading towards north.

Source: www.investopedia.com

The stock price is moving north. In this pattern, cup formation is developed during price rallies from the round bottom. The next pullback carves out a rounding bottom no deeper than the 50% retracement of. After forming the cup, price pulls back to about ⅓ of the cups advance, forming the handle. The cup and the handle.

Source: swingtradebot.com

17/1/22 sail cup and handle formation cup and handle formed on a weekly time frame cmp@107.65 the targets will be @125/142/150/174/194. The cup can be spread out from 1 to 6 months, occasionally longer. An ‘inverted cup and handle’ is a chart pattern that indicates bearish continuation, triggering a sell signal. In the domain of technical analysis of market prices,.

Source: scanz.com

Cup and handle chart pattern: The figure on the right shows an example of a cup with handle chart pattern. The stock price is moving north. The cup and handle pattern is a common. As its name implies, there are two parts to the pattern:

Source: www.fidelity.com

After forming the cup, price pulls back to about ⅓ of the cups advance, forming the handle. A cup and handle are considered a signal of progress, and they are used to detect. A cup and handle pattern is a bullish continuation pattern.this stock is making a cups and handles in its daily time frame. The cup part of the.

Source: www.investopedia.com

The chart structure positive and entry will cup & handle neckline breakout at rs 4000 call writer are squaring their position at 4000, 4100 and 4200 and significant put writing as 3900. The cup and the handle. The first target should be equal to the size of the handle, while the second target should be equal to the size of.

Source: forexop.com

Cup & handle pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. The next pullback carves out a rounding bottom no deeper than the 50% retracement of. Chart patterns occur when the price of an asset moves in a way that resembles a common shape, like.

Source: www.newtraderu.com

A classic cup w handle pattern formation can take an entry with an sl. After that break, the stock again starts heading towards north. These are very reliable and offer great trades. The stock price is moving north. In between it takes a break, it forms a pattern that resembles a cup with a handle.

Source: www.pinterest.com

These are very reliable and offer great trades. 17/1/22 sail cup and handle formation cup and handle formed on a weekly time frame cmp@107.65 the targets will be @125/142/150/174/194. Nse:easemytrip easy trip planners ltd. It can take some time for this pattern to develop. A cup and handle are generally considered to be a bullish continuation form.

Source: www.binaryoptions.net

The cup and handle is an accumulation buying pattern, which is found during long periods of consolidation, and can lead to powerful explosive moves once the pattern is fully completed. It´s one of the easiest patterns to identify. The cup and handle chart pattern is a continuation chart pattern and it is generally formed in the bullish market. Cup &.

Source: tradingsim.com

The cup and handle pattern is formed when prices tend to bottom out, forming a gradual decline and then a smooth rally higher. Cup and handle chart pattern: Cup & handle pattern technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. 17/1/22 sail cup and handle formation.

Source: www.dailyfx.com

The handle breakout is a way of confirming the pattern. After that break, the stock again starts heading towards north. Nse:easemytrip easy trip planners ltd. Pop probability is looking good. The chart structure positive and entry will cup & handle neckline breakout at rs 4000 call writer are squaring their position at 4000, 4100 and 4200 and significant put writing.

Source: school.stockcharts.com

The figure on the right shows an example of a cup with handle chart pattern. Hfcl is at ath and at llr. These are very reliable and offer great trades. An ‘inverted cup and handle’ is a chart pattern that indicates bearish continuation, triggering a sell signal. After that break, the stock again starts heading towards north.

Source: www.ig.com

Trend analysis chart patterns cupandhandlepattern sail saillong. The rise leading to the cup with handle begins at c and reaches the left cup lip at point a.since this is on the weekly scale, the price chart appears narrower than usual, but price rounds downward forming a cup with the right cup lip at b.the handle lasts a few weeks. How.