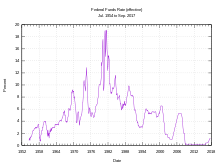

Prime Rate History Chart . The bank prime loan rate reached as high as 20% in 1981, when the federal reserve was led by paul volcker, and the interest rate environment was extremely inflated. The prime rate is defined by the wall street journal (wsj) as the base rate on corporate loans posted by at least 70% of the 10 largest u.s.

File:history Of Prime Rates And The Bank Of Canada Target Overnight Rate.png - Wikimedia Commons from commons.wikimedia.org

Effective date cibc prime effective date cibc prime effective date cibc prime effective date cibc prime december 21, 1992 7.75% july 26, 1996 6.25% april 14, 2004 3.75% december 22, 1992 7.50% august 12, 1996 6.00% september 9, 2004 4.00% december 23, 1992 7.25% august 23, 1996 5.75% october 20, 2004 4.25% january. Historical chart of the effective federal funds rate in the united states, the prime rate runs approximately 300 basis points (or 3 percentage points) above the federal funds rate, which is the interest rate that banks charge each other for overnight loans made to. Interest rates will be on september 22, 2021.

File:history Of Prime Rates And The Bank Of Canada Target Overnight Rate.png - Wikimedia Commons

The prime rate, or prime lending rate, is the interest rate a financial institution uses as a base to determine interest rates for loan products. The graph and chart reported below are based upon the rates on the first day of each respective month over the past decade. Historical data view and export this data back to 1975. The fomc has voted to leave the.

Source: en.wikipedia.org

The prime rate has moved massively over time, ranging from historic highs around 23% in the early 1980s, to historic lows of 2.25% following the great recession. If you'd like to access the data for the charts you can download that here. In recent history, the prime interest rate has been set at 3% over the high end of the.

Source: www.ratespy.com

You can also see the impact to your payments by logging on to mymcap and viewing your mortgage details. View wsjprime interest rate data and compare to other rates, stocks and exchanges. Rather, we have responsibilities for canada’s monetary policy, bank notes, financial system, and funds management. The prime rate, or prime lending rate, is the interest rate a financial.

Source: www.primerates.com

2009) longest period of no change: Each financial institution sets its own prime rate, as a function of its cost of funding, which, in turn, is influenced by the target for the overnight rate set by the bank of canada. Wsj us prime rate advanced interest rate charts by marketwatch. This is lower than the long term average of 7.83%..

Source: www.fedprimerate.com

Rates for 02 january 2022. 10 year p rime lending rate chart 60 year historical prime rate graph : The prime rate has moved massively over time, ranging from historic highs around 23% in the early 1980s, to historic lows of 2.25% following the great recession. Td prime rate is the variable annual interest rate published by us from time.

Source: www.moneycafe.com

Prime rate is the base rate on corporate loans posted by at least 70% of the 10 largest u.s. Td prime rate is the variable annual interest rate published by us from time to time as our td prime rate and is the interest rate we will use as a reference to determine the interest rate that we will charge.

Source: commons.wikimedia.org

Prime rate history | mcap effective april 2, 2020 mcap prime rate is 2.45%. Click the link below for the forecast. We are not a commercial bank and do not offer banking services to the public. Historical data view and export this data back to 1975. You can also see the impact to your payments by logging on to mymcap.

Source: paulfoley-wellsfargo.blogspot.com

The prime rate is defined by the wall street journal (wsj) as the base rate on corporate loans posted by at least 70% of the 10 largest u.s. Please review its website terms, privacy and security policies to see how they apply to you. Prime rate) july 28, 2021: Rate [ % ] date of change (yyyy/mm/dd) royal bank prime..

Source: cybercalc.wordpress.com

Therefore, the united states prime rate remains at 3.25%. The prime rate, or prime lending rate, is the interest rate a financial institution uses as a base to determine interest rates for loan products. Rate [ % ] date of change (yyyy/mm/dd) royal bank prime. You can also see the impact to your payments by logging on to mymcap and.

Source: david-decoteau.squarespace.com

Treasury bonds, libor rates and much more. The bank of canada is the nation’s central bank. When the mcap prime rate changes, you will receive a letter indicating the new prime rate and its effective date. Prime rate) july 28, 2021: Therefore, the united states prime rate remains at 3.25%.

Source: www.ellahao.com

The prime rate is driven by the overnight rate as set by the bank of canada. All quotes are in local exchange time. Bank lending rate in canada averaged 7.09 percent from 1960 until 2022, reaching an all time high of 22.75 percent in august of 1981 and a record low of 2.25 percent in april of 2009. The graph.

Source: www.howtosavemoney.ca

View wsjprime interest rate data and compare to other rates, stocks and exchanges. The following chart displays the prime interest rate for the last 65 years up until today, giving a good idea of how the prime rate has changed in the past. Rate [ % ] date of change (yyyy/mm/dd) royal bank prime. Click the link below for the.

Source: www.forecast-chart.com

Other prime rates aren't directly comparable. Therefore, the united states prime rate remains at 3.25%. Treasury bonds, libor rates and much more. This is lower than the long term average of 7.83%. Bank lending rate in canada averaged 7.09 percent from 1960 until 2022, reaching an all time high of 22.75 percent in august of 1981 and a record low.

Source: takloo.wordpress.com

Updated tuesday, december 18, 2018. If you'd like to access the data for the charts you can download that here. Other prime rates aren't directly comparable. Historical data view and export this data back to 1975. The prime rate has moved massively over time, ranging from historic highs around 23% in the early 1980s, to historic lows of 2.25% following.

Source: en.wikipedia.org

In recent history, the prime interest rate has been set at 3% over the high end of the range for fed funds. Click the link below for the forecast. View full chart loading chart. When the mcap prime rate changes, you will receive a letter indicating the new prime rate and its effective date. Bank lending rate in canada averaged.

Source: fred.stlouisfed.org

Interest rates will be on september 22, 2021. The prime rate, or prime lending rate, is the interest rate a financial institution uses as a base to determine interest rates for loan products. Click the link below for the forecast. Each financial institution sets its own prime rate, as a function of its cost of funding, which, in turn, is.

Source: en.wikipedia.org

Td prime rate is the variable annual interest rate published by us from time to time as our td prime rate and is the interest rate we will use as a reference to determine the interest rate that we will charge to customers for certain credit products provided by us in canadian dollars in canada. Prime rate is the base.

Source: www.ellahao.com

Banks, and is effective 3/16/20. This is lower than the long term average of 7.83%. The overnight rate is rate at which banks lend to each other. All quotes are in local exchange time. 2015) since the bank of canada started inflation targeting in 1991, the average bank of canada rate hike cycle has lasted 2.29 percentage points (as measured.

Source: en.wikipedia.org

Our principal role, as defined in the bank of canada act, is to promote the economic and financial welfare of canada." Historical chart of the effective federal funds rate in the united states, the prime rate runs approximately 300 basis points (or 3 percentage points) above the federal funds rate, which is the interest rate that banks charge each other.

Source: mortgage-x.com

A series of current and historical charts tracking bond yields and interest rates. This is lower than the long term average of 7.83%. The following chart displays the prime interest rate for the last 65 years up until today, giving a good idea of how the prime rate has changed in the past. Our principal role, as defined in the.

Source: fitsmallbusiness.com

Each financial institution sets its own prime rate, as a function of its cost of funding, which, in turn, is influenced by the target for the overnight rate set by the bank of canada. Stock quotes reflect trades reported through nasdaq only. The prime rate, or prime lending rate, is the interest rate a financial institution uses as a base.